Today’s highly developed world and day to day growing competition makes all companies to work hard and look for new ways to expand and obtain additional clients. For this reason companies seek ways to more effectively use their time and resources, cut costs, offer additional services and facilitate their operational work.

In this situation the most important decision that you can make is to outsource some of your company’s functions which will provide more benefits and give solutions to many problems.

Outsourcing is a growing trend worldwide assuring benefits from use of experienced professionals, enhanced processes and technologies, and stronger compliance measures.

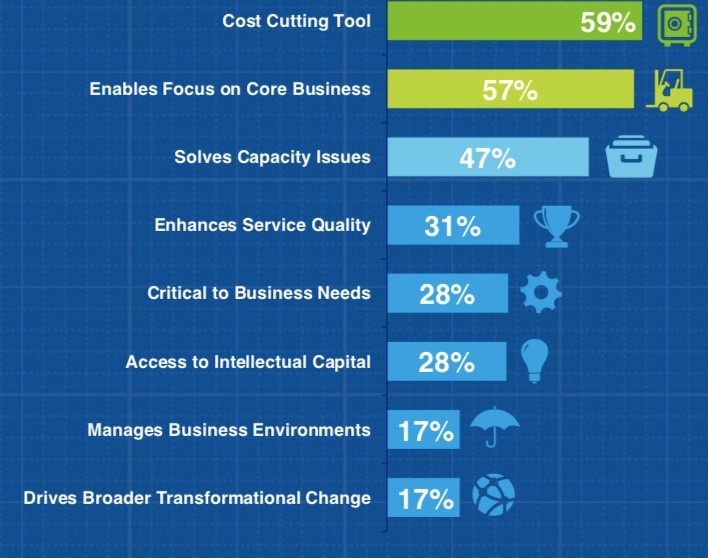

Cost, enabling core business functions, and solving capacity issues are primary drivers to outsource. Leading practice organizations use outsourcing to drive transformational change and improve business results.

It is easier to develop your business, focus on your core work, establish long-term strategic goals and effectively achieve them, when you outsource bookkeeping operations to more professional and experienced companies.

It seems to be true for every company. But what if you are one of the companies that provide the financing and accounting services for your clients? Will outsourcing your bookkeeping operation will have the same positive effect for you as for other companies. It seems that you have the knowledge, human resources, all hardware and software that is needed for precise accounting and you can do it for yourself as for others in the same easy way.

But even it will sound odd and surprising for you: it’s is true even for CPA (Certified Public Accountants) firms as for others.

Yes, you have all necessary sources, but think that you can use those sources for your clients and focus on services that you provide by adding new valuable ones and focusing on the individual needs of your clients which will keep you competitive in the market.

Here are top 5 reasons, why you as CPA Firm should outsource your bookkeeping process.

- Save time and focus on your core services. As was mentioned above for staying competitive you should think about offering new and high-end services for your clients, for example financial planning and management consultancy, insurance products, investment management, tax planning, HR management, etc. But for doing all this you need more resources, time and focus, so you should consider focusing on your core CPA services rather than hiring and training bookkeepers for your company. Start to focus your energy and time on more complex tasks and make “added value” for your clients.

- Choose cost-effective way. The cost of bookkeeping outsourcing services are lower than hiring, training and maintaining of accounting staff, paying salaries and benefit costs- no overtime pay, no health insurance benefits, no need for office equipment. In this way you only pay for what you need and by saving of current costs up to 50% keep your prices competitive. You cut your costs also by automating and reducing paper. You decrease your carbon footprint and reduce wasted paper, as well as costs of maintaining your fax machine, printers and copies.

- Maintain your documents more safe. When you grow the business and services, then managing data and documents of increased services is becoming more complicated and causes many problems. By outsourcing bookkeeping process you acquire a chance to facilitate the storing of your documents and maintain the highest level of security.

- Be more flexible. You can manage your work schedule and set it according to your client’s needs and expectations, be always available for them which is the core value for outsourcing services. All bookkeeping tasks, such as payroll accounting, managing tax returns, ensure accurate depiction of the accounts are exhausting, time consuming and require a lot of responsibilities, so facilitating all these functions will give you a great elasticity. The outsourcing may especially provide you additional accounting assistance during the pic periods such as tax season and manage the workload and stress caused by lack of time and resources.

- Meet all unique business requirements of CPA firms and reduce risk. The firms that are providing bookkeeping services for CPA firms have more skilled stuff that are aware of the latest bookkeeping practices for CPA firms and have years of experience in that special filed. They will provide customized bookkeeping services, more accurate write-up services, maintain transparency within your accounts, regularly update and maintain your financial statements, do your CPA Tax and Sales preparation, Knowing that all these responsible activities are taken by bookkeeping experts without your time and effort expended gives you confidence and peace of mind. Moreover, you get third party that audits your accounting process which decreases the risk of mistakes and problems with governmental and regulatory services. With today’s advanced technologies and software you have an access to your financial data anytime anywhere which gives you a total visibility into your business’s accounting process which allows you to make more confident and informed decisions.

If you are a manager or CEO of CPA form and seek a solution whether outsource your bookkeeping process take a time and consider all these added benefits of outsourcing and achieve your success in a more vivid manner.

“With the advent of cloud technology and globalization, we see outsourcing as a viable option now particularly the accounting industry.”

“A large number of firms are advertising to graduates stating — you’ll never have to do a tax return. You’re coming into the business for an advisory role — with a lot of the compliance work being outsourced to a global team, it provides a great opportunity for graduates to focus on local client facing work.”

Nick Sinclair, CEO of The Outsourced Accountant (TOA)